Benefits Increase - PSBT

Improving the PSBT Benefits Plan

Update: April 29th, 2025

As Trustees of the Power Sector Benefit Trust (PSBT), we are writing to provide you with our annual update.

For newer Members that may not be familiar with the Power Sector Benefit Trust it is helpful to review the foundation of the Plan. The Trust is managed by Plan Members for Plan Members and their families. The Trust is not a 3rd Party commercial benefits Plan provider. As Plan Members, we set the level of coverages and we set the level of premiums needed to cover the cost of the claims, based on the usage of benefits by the Plan Members and their families. The formula is simple. The PSBT pays for what the Plan Members use. The PSBT Plan has been in place for more than 25 years and as a result, we have been able to track our group claims experience to make accurate projections of current costs and future increases due to industry trends and inflation.

The Governance Model, adopted by the Trustees, requires an annual review of the operation of the Plan that includes reports from our benefits consultant, Sonny Goldstein, Nesbitt Burns who manage our Health and Welfare Plan Investments, Canada Life who provide administrative services, and Homewood Health that supports our internal Member and Family Assistance Plan. We engage our Partners in providing the Trustees with updates to the latest economic trends in the industry as well as current directions in health and wellness within the broader Canadian society. The reports are used by the Trustees when considering the benefits that are provided by the Plan going forward.

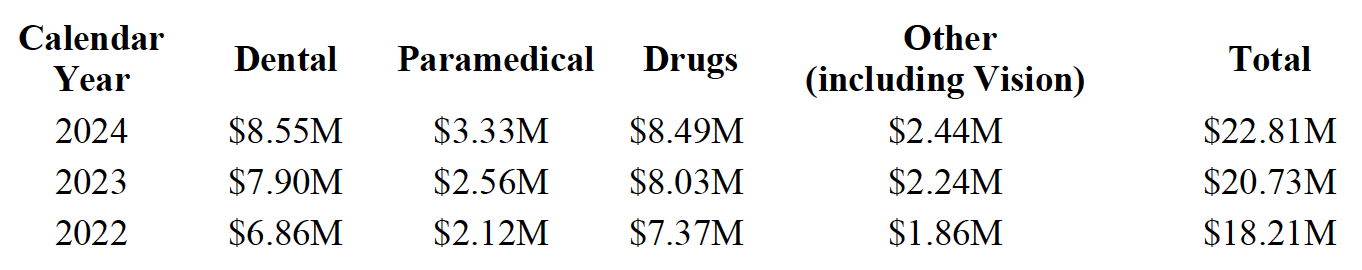

Our Plan has experienced consistent increases in claims across all major benefit categories since 2022 as detailed below:

This represents a 10% increase from 2023 to 2024, with a projected 5% increase for a total of $24.0M for the current 2025 year. Emerging trends such as a projected 58% increase in GLP-1 drug usage (e.g., Ozempic) over the next two years are placing further cost pressures on the Plan.

The Plan is funded through your Health & Welfare hourly contributions that are negotiated as part of the total wage package in your collective agreements, and remitted by the employers to PSBT as required by the collective agreement. Canada Revenue Agency recognizes that contributions sent to a Multi-Employer Benefit Trust Fund designated for the purchase of benefits are remitted without any tax being paid at source by the Member. As long as these funds are used to purchase benefits through the Trust, there would be no tax implications to the member. These contributions are made to the Trust, and not to individual members. For Plan Members, where employers are paying the premium directly on behalf of their employees, the same tax arrangement applies. The Trust Fund also includes an option in the Plan rules that allows Members of the Plan to become a Pay Direct member and make payments directly to the Plan when there are insufficient funds from employer contributions in their account to continue the payment of the premiums. Pay Direct payments are subject to RST, which is removed from the amount deposited to the account.

The Power Sector Benefit Trust is a Group Plan. Premiums are based on the claims experience of the group and not the claims experience of individual members. The premium is set based on the level of coverage provided through the Plan, as set by the Members, and the level of usage of the coverage available for the Members and their families. There is a monthly rate set for family and a monthly rate set for single coverage based on age over or under 65. These rates apply to all Members regardless of individual usage of the Plan.

After a thorough review of the annual reports and an in-depth assessment of the current Plan usage, the Trustees have made the decision to increase the monthly premium by $30.00/month to maintain the level of coverage approved by the Plan Members, and to delay the implementation of coverage increases to the Life Insurance and Long-term Disability benefits. This decision was not made easily and was made with the long-term sustainability of the Plan in mind.

In the best interest of all Plan Members, the decision was based on several key factors, including:

- The actual usage trends compared to original projections.

- The financial sustainability of the benefit pool.

- The goal of preserving benefits for all Plan Members.

- Our commitment to fairness and shared responsibility.

The new rate chart is below:

We appreciate your understanding and continued support as we work together to maintain a strong and sustainable benefit Plan for everyone.

Warm regards,

On behalf of the Trustees,

Bob Hamilton

Gary Fiege

Jennifer Whyte (PWU)

Don Levesque

Melissa Baron

Previous Updates:

Dear Member,

We greatly appreciate your participation in the ballot and surveys, as this is a great example of democracy at work. The results of the PSBT ballot that took place earlier in 2024 have been tabulated and reviewed by the Trustees.

We are pleased to let you know that all of the items on the ballot were accepted by the PSBT members and that you will see an increase in coverage to the items that were voted on. The improved benefits will be phased into the plan in increments.

The total cost to increase the benefits on the ballot was $60.90/month, which the membership voted to accept by accepting all of the ballot items. This will apply to both single and family coverage.

We appreciate your patience over the last few months while we have worked on the costs and logistics of increasing the benefits coverage while considering what would be in the best interest of the membership. The changes that are outlined below were carefully considered in what would be possible to implement with the various employers and the pay-direct members. Any claims associated with the below changes prior to September 1st, 2024, will not be eligible for submission.

The Trustees have decided to phase the increases as follows:

Effective September 1st, 2024:

- Moved that the Dependent Child Orthodontic coverage be increased from a maximum of $2000 at 50%, to a maximum of $3000 at 75% (Accepted by 53.42%)

- Moved that the Major Restorative Dental coverage increase from a maximum of $2000.00 at 50%, to a maximum of $3000.00 at 75% (Accepted by 73.77%)

- Moved that the Vision Care be increased from $400.00 to $600.00 every 2 years (Accepted by 84.07%)

- Moved that the Para-Medical Coverage increases from $500.00 to $1000.00 annually (Services such as massage, chiropractic, psychology/psychotherapy, etc.) (Accepted by 79.39%)

Any claims associated with the above changes prior to September 1st, 2024, will not be eligible for submission.

If you have a claim that is denied for one of the above items, please reach out to PSBT for assistance.

Effective January 1st, 2025:

A rate increase of $30.00/month will take effect to cover the costs of the increases that were implemented in September 2024.

The delay in changing the premium rate until January 2025 is to give time for the administrative changes to take effect while still allowing the membership to access the increased coverage.

Tentative Plan for May 1st, 2025:

This is the date of PSBT’s annual plan renewal with Canada Life. Since the rates are negotiated annually for May 1st, this is a tentative plan and what we expect the changes to be, however until we complete negotiations it would not be possible to give a definitive 2025 rate for the below changes.

- Moved that the Life Insurance coverage increases from $100,000 to $200,000 (Accepted by 63.59%)

- Moved that the Long-Term Disability coverage increase from 70% of the member’s monthly wage to a maximum of $2800.00 per month, to 70% of the member’s monthly wage to a maximum of $3500.00 per month (Accepted by 69.22%)

The above changes will tentatively take effect May 1st, 2025, with an increased cost of $30.90/month to the members.

The Benefits Booklet will be updated to reflect these changes when the 2025 version is available.

On behalf of the Trustees,

Craig Batty

PSBT Administrator

To All Members of Power Sector Benefit Trust,

We are still in the process of reviewing the results of the ballot.

We appreciate your participation in the ballot, and we acknowledge your anticipation to know the results of the vote.

Due to a variety of scheduling factors, the Trustees have not yet been able to meet with Canada Life regarding the results of the vote, and what any potential implementation of the results could look like.

A meeting is scheduled for July 2024, and we will be able to provide you with a definitive update regarding the results of the ballot by the end of July. We recognize this has taken longer than expected, and we thank you for your patience.

We will keep everyone informed as we continue this process.

Sincerely,

Power Sector Benefit Trust

We are in the process of reviewing the ballot results.

Once the numbers between the mail-in and electronic ballots are finalized, the results will be sent to the Trustees for review. During this review, the Trustees will contact Canada Life to advise them of any requested changes and establish a timeline for implementing the changes into the benefits plan.

After confirmation from Canada Life is received, PSBT will send another communication bulletin to advise you, the membership, about the changes being made, the timing, and any additional costs.

We will keep everyone informed as we continue this process.

Thank you,

Power Sector Benefit Trust

Our recent annual benefits survey resulted in an expressed interest from the Members of the plan, requesting changes to certain coverage levels within the PSBT benefits plan.

The items identified by the Members participating in the survey include an improvement to certain benefits, including major dental, orthodontics, vision care, para-medical services, life insurance, and long-term disability coverage.

Each year, on May 1st, the Trustees renew our agreement with Canada Life. The terms of the plan are negotiated, and the costs to maintain the plan for the next year are reviewed.

When considering the results of the annual benefits survey, the Trustees recognize that the members wish to see the current plan maintained and an improvement in certain coverages within the benefit plan. The coverages that the Trustees are recommending are included on the ballot: improvements to major restorative dental coverage, children’s orthodontic coverage, vision care, para-medical services (such as massage, chiropractic, psychology/psychotherapy, etc.), life insurance, and long-term disability. Each of these items will be listed on the ballot, with proposed improvements to the level of coverage, and what the premium increase would be for those specific benefits. Only the benefits receiving a majority number of votes will be increased. The cost associated with each improvement is listed on the ballot and would come out of the Member’s Health & Welfare Account.

Should all the improvements on the ballot be accepted, the total increase in monthly premiums would be $60.90 per month to cover the increased premium costs. This monthly amount could be lower depending on how many items are accepted, and the varying rates are listed on the ballot.

Note: For those of you who are new to the PSBT, health & welfare hourly contributions are negotiated as part of the total wage package and remitted by the employers to PSBT as required by the collective agreement. Canada Revenue Agency recognizes that contributions sent to a Multi-Employer Benefit Trust Fund designated for the purchase of benefits are remitted without any tax being paid at the source by the member. If these amounts are left on your paycheck they will be taxed at your highest marginal rate, which could be up to 50%.

Please watch for an email with your ballot and voting instructions arriving in the next few days.

Questions can be directed to [email protected]